tax reduction strategies for high income earners australia

For example if you are making a 1 million. For the sake of this post we consider anybody in the top three tax brackets as a high-income earner.

Disparity In Income Distribution In The Us Deloitte Insights

This field is for validation purposes and should be left unchanged.

. STRATEGY 4 TAX SOLUTIONS FOR HIGH INCOME EARNERS. One can avail of this benefit provided you are married file a joint tax return and the home is the primary residence. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia.

A DRG deductible gift recipient is an ATO recognised organisation or fund that can receive tax-deductible gifts. Distribute more income to beneficiaries on lower tax brackets or. A properly drafted discretionary trust allows trustees to distribute to the most appropriate members regarding their tax status ie.

If you have 100000 of assessable income for the year your tax payable would be approximately 26000. But sometimes people drive down their income a great deal which greatly reduces how much tax they have to pay. Overview of Tax Rules for High-Income Earners.

There were 70 people like Tony who earned more than 1 million in total income but. How to Reduce Taxable Income Through Charitable Donations. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income.

A discretionary family trust can benefit high-income earners seeking to redistribute some of their income to family members in lower tax brackets. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. She also has a partner who earns a salary of 180000 pa.

Jane earns 230000 salary per year and has 2 adult children of 19 and 18. I Have Dug Deeper Into Ways Middle To Upper Income Tax Payers May Reduce Tax Income Tax. The tax benefit of salary sacrifice super contributions is now more significant with the higher individual tax rates.

However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. Tax minimisation strategies company pdf. Australias income tax system is undergoing a radical overhaul designed to reduce tax for the majority of individuals protect middle-income earners from bracket creep and simplify the system.

Many Australian Tax Videos Are Discuss The Same BORING Strategies. If you are a high-income earner who is planning to sell your primary residence then you may further save on your tax on up to 500k of your capital gains. One way to reduce your taxable income is to donate to a DRG organisation.

A tax offset of 10000 would reduce your tax payable down to 16000. The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income. Leverage Home Sales Tax.

I Have Dug Deeper Into Ways Middle To Upper Income Tax Payers May Reduce Tax Income Tax. As a refresher for 2021 fy the individual tax rates including medicare levy are. CommInsure Investment Growth Bond Strategy Series.

Lets start with an overview of tax rules for high-income earners. Dont waste your good fortune or hard work by not assessing if you are using the system to your advantage. A discretionary family trust can be beneficial for high income earners who are seeking to redistribute some of their income to family members on lower tax brackets.

Vehicle and travel expenses. Tax reduction strategies for high income earners australia Tuesday March 1 2022 Edit. 1 Includes Medicare Levy of 2pa and Temporary Budget Repair Levy of 2pa.

Using a Discretionary Trust to reduce taxes. High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead.

So Call us on 0280625961 or Book an Appointment. Because of the way Australias income tax system is structured moving. Franking credits are a kind of tax credit that allows Australian companies to pass on the tax paid at company level to shareholders.

50 Best Ways to Reduce Taxes for High Income Earners. Additionally tax-deferred accounts benefit by compounding. High Income Financial Planning Reduce Tax and Build Wealth.

Here are some of our favorite income tax reduction strategies for high earners. Your information is secure and confidential. Knowing the right tax reduction strategies for high-income earners is key to lowering your income taxes.

TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA. That means that if you earn more than 170050 in. Use the 50 active asset reduction.

For income levels between 273000 and 300000 it will be between 34 and 19 and for income levels above 300000 the saving will be 19. Both are studying and will continue education for another 5 years. The contribution you will make.

While the Coalition governments seven-year Personal Income Tax Plan was originally laid out in the 2018 Federal Budget the timetable has been. A tax offset is a direct reduction on the amount of tax you need to pay. In many cases the tax savings can be tens of thousands even hundreds of thousands of dollars in a very short period of time.

The ATO considers some expenses as valid ways to reduce tax payable however how and when the reduction is applied on the assessable income depends on the type of expense. Find out how to lower your tax bill for 2020. Exploring tax savings through depreciation superannuation SMSFs and capital.

Come in for a review at no cost and see what possible. High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice. For taxable income levels between 180000 and 273000 the tax saving will be 34.

The higher your tax bracket the higher the benefits are of tax savings. This rate is lower than the lowest marginal tax rate therefore you will save tax by doing it. Tax deduction versus tax offset.

Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post.

Disparity In Income Distribution In The Us Deloitte Insights

10 Easy Ways To Reduce Tax More Tips From The Etax Experts

Tax Planning Income Tax Reduction Strategies For High Income Earners

Quadrennial Report On Regional Progress And Challenges In Relation To The 2030 Agenda By Publicaciones De La Cepal Naciones Unidas Issuu

Advanced Tax Strategies For High Income Earners In Australia Solve Accounting

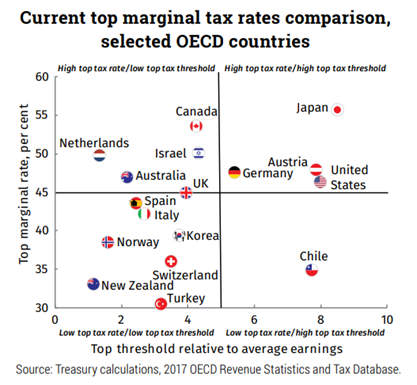

Tax Reform Welcome But More To Do Betashares

The Super Rich And Tax Lifters Or Leaners

Australia Let S Talk About Income Tax Reform Savings Com Au

Tax Planning Income Tax Reduction Strategies For High Income Earners

Livevesting A Strategy That Might Suit Some Higher Income Earners

What Are Marriage Penalties And Bonuses Tax Policy Center

Advanced Tax Strategies For High Income Earners In Australia Solve Accounting

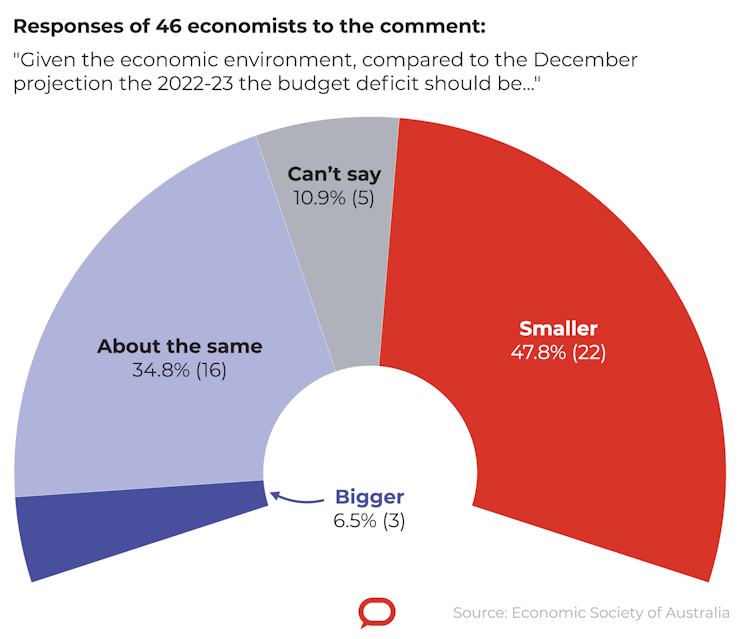

Cut Emissions Not Petrol Tax What Economists Want From The Budget

The Australia Institute 2019 Budget Wrap By The Australia Institute Medium

.png)

Top Tax Planning Strategies Bluerock

Bracket Creep Berita Riset Dan Analisis The Conversation Laman 1

Tax Planning Income Tax Reduction Strategies For High Income Earners